4 min read

Defense Industry Trends: Jumpstarting the Arsenal of Democracy

![]() Dave Biering

January 12, 2024

Dave Biering

January 12, 2024

The defense industry has always been at the forefront of innovation, with many military advances eventually making their way into the civilian economy. At the same time, the military has also proven its ability to keep legacy equipment running decades after its initial deployment, so long as it continues successfully performing its mission (like the venerable B-52). For a look at the historical development of the U.S. defense industry, please see our blog here. In this article, we focus on trends shaping the future of the U.S. defense industry.

Trend One: Preparing for a Decade of Renewed Growth

With defense budgets more stable than civilian travel, many defense contractors weathered the storm of COVID with relative stability. For the first time in 2022, the defense-focused Lockheed and Raytheon topped the list of US Aerospace and Defense companies by revenue (long crowned by the civilian-focused Boeing and Airbus, learn more in our aerospace overview here).

Now, rising geopolitical tensions are sparking a new wave of military spending globally, including extensive modernization in Europe (see Trend Two below), and global defense spending appears sure to accelerate for the foreseeable future. Simply replacing the NATO equipment sent to Ukraine represents an estimated $20 billion opportunity for the U.S. defense industry.

In its 2023 industry report, Deloitte notes that “The defense segment remained stable through 2022 and is expected to outperform the commercial aerospace segment as an increase in defense budgets in the wake of the invasion [of Ukraine] is boosting demand for military equipment globally.”

Trend Two: A New Wave of Spending in Europe

The war in Ukraine is driving a transformation of the European defense industry along two axes, helpfully outlined in this article from Defense and Security Monitor. First, many European countries substantially depleted their stocks of equipment, including Warsaw Pact vintage equipment that will now need to be replaced by U.S. and EU manufacturers. “The Czech Republic, Estonia, Latvia, and Poland are among the top European countries looking to quickly replace these systems,” notes this report, and “increased demand for NATO-interoperable equipment has strained defense manufacturers, with Lockheed Martin and Northrop Grumman quoting delivery dates for backlogged orders at over a year.”

Second, many EU countries have embarked on a large-scale modernization program, already shaped by practical lessons from the Ukraine War: “Between 2015 and 2019, the Eurofighter Typhoon, Dassault Rafale, and P-8 Poseidon aircraft, SAMP/T anti-aircraft weapon, NASAMS ground-based air defense system, and Leopard 2A tank were among the most sought after equipment by European countries. Post 2022, Europe has turned its focus to hypersonic weapons, vertical takeoff and landing (VTOL) aircraft, unmanned aerial vehicles (UAVs), and next-generation nuclear naval assets.” Overall spending by EU governments is surging. Total defense spending exceeded €200 billion for the first time in 2022 and has already eclipsed €300 billion in 2023.

With backlogged orders and strong demand for the foreseeable future, the next decade will likely see a substantial upswing in defense industry investment.

Trend Three: A New Surge of Investment in the Traditional Defense Industrial Base

The war in Ukraine has awakened long-dormant concerns about the defense industrial base’s production capacity for not only new technology like UAVs but basic supplies like artillery shells. For example, Ukraine is consuming thousands of shells per day, and Western defense suppliers are struggling to keep up.

“Refilling inventories in a reasonable timeframe or preparing for surge more generally may require contractors to invest in additional capacity to allow for production to increase,” notes a report on “Reviving the Arsenal of Democracy” from the Center for Strategic and International Studies. “For a long war against a more capable adversary, the United States may need to more directly draw on its industrial base, with production going directly from the factory to the front. After a year of supporting Ukraine primarily out of existing stockpiles... engaging the United States’ larger manufacturing sector for a longer-term production increase will be a more significant effort.”

Trend Four: A New Focus on Mitigating Supply Chain Risk

While the defense industry weathered the COVID-19 slowdown with relative stability, this disruption still showcased the vulnerability of increasingly complex global supply chains for defense manufacturers. The DoD and OEMs have taken note, and the coming years will see a major effort to simplify, streamline, and re-shore defense manufacturing capabilities while improving resilience. Deloitte notes that:

“Given these challenges, the coming year will likely see an acceleration of the shift from global to regional sourcing, including the exchange of raw materials, parts, and finished A&D goods globally. Companies will likely emphasize supply chain diversification, including local sourcing and nearshoring, to avoid concentration risk. They are also likely to build relationships with suppliers from countries with free trade agreements (FTAs).”

The supply chain for semiconductor manufacturing provides an instructive example. The Department of Defense played an active role in shaping CHIPS Act provisions supporting microelectronics R&D, explained here by McKinsey. We take a deeper look at the challenges associated with semiconductor manufacturing in our guide here.

Trend Five: The UAV Boom Continues to Accelerate

Unmanned Aerial Vehicles (UAVs) have dominated headlines since MQ-1 Predators began supplying loitering video feeds of the conflicts in Iraq and Afghanistan. CIA-modified versions of the Predator were armed with Hellfire missiles since the year 2000, and by 2008, dedicated UCAVs (unmanned combat air vehicles) entered service in the form of the MQ-9 Reaper.

The shift to a conventional war in Ukraine has only accelerated the trend toward drone-heavy warfare. An informative summary of key trends from Defense and Security Monitor observes that “with the proliferation of cheaper unmanned aerial systems (UASs) and loitering munitions, the aerial battlespace has been drastically altered... Swarms of small, munition-carrying drones present challenges for ground and naval forces alike and create vulnerabilities for critical infrastructure, fixed strategic posts, and mobile forces.”

The US defense industry will be challenged to respond to this new reality in the coming decade, including the need to produce not only advanced drones but highly cost-effective, disposable battlefield systems. For a deeper look at the rising demand for military drones and their increasingly complex array of roles in recent conflicts, this report from the CSIS provides an excellent resource.

Learn More: Advanced Polymers Help Defense OEMs Tackle Tough Challenges

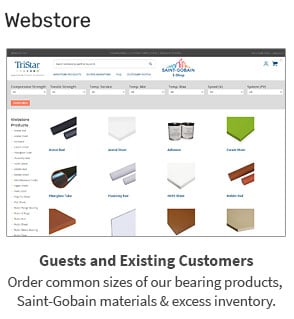

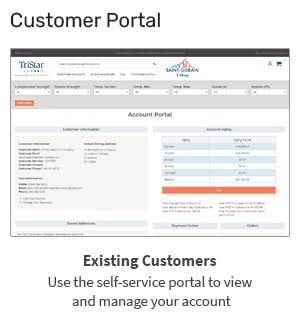

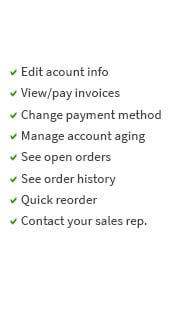

TriStar works with a broad variety of defense OEMs, leveraging our hands-on engineering experience and extensive arsenal of materials to tackle tough engineering challenges.

For a deeper dive into the biggest challenges for defense industry components (and how TriStar’s high-performance polymers can help solve them) please see our guide here.